Qualified Small Business Stock (QSBS) Attestation Letter

Jul 22, 2025Qualified Small Business Stock (QSBS) represents a significant tax benefit, offering potential tax exclusions of up to $15 million or 10 times your investment basis. This can save startup founders and investors $3 million or more in capital gains tax.

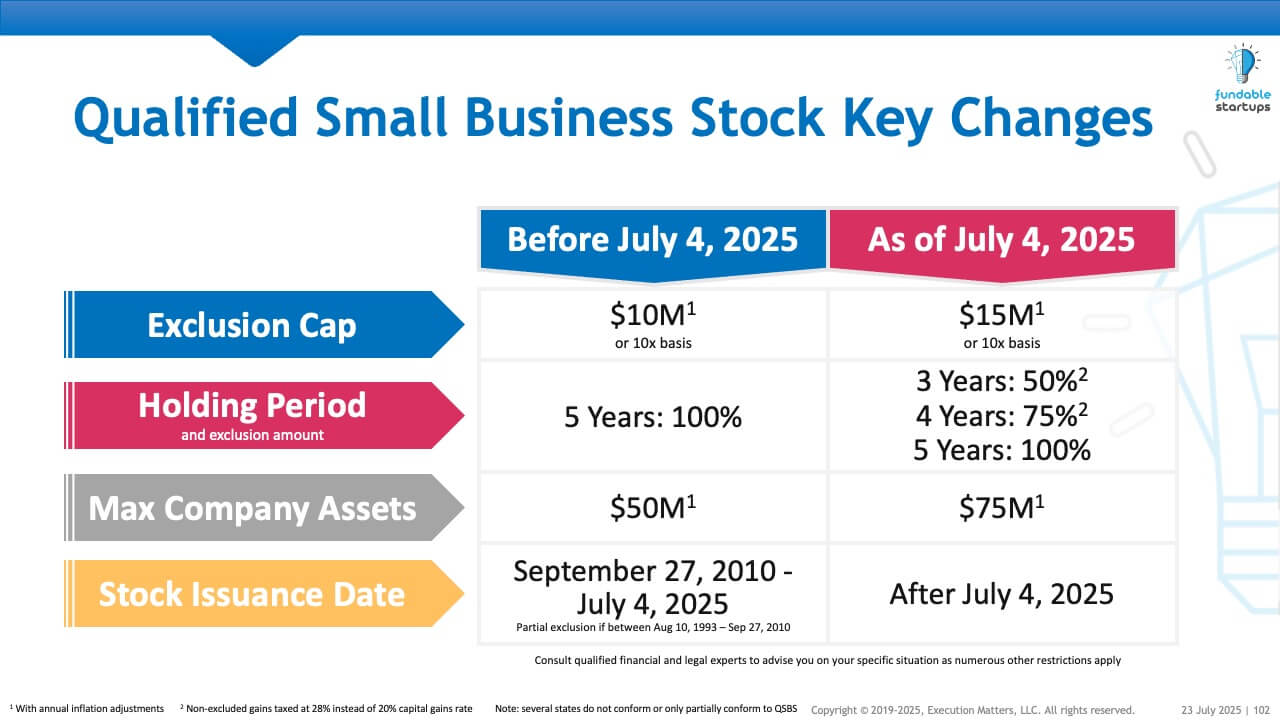

Three Major Changes to QSBS

With the passage of the One Big Beautiful Bill (OBBB) on July 4, 2025, QSBS was thrust into the limelight due to three significant changes:

- Increased the maximum exclusion from $10M to $15M

- Added partial exclusions for stock held for less than 5 years

- Increased the maximum company asset threshold from $50M to $75M

The slide below summarizes the key changes to QSBS.

Tax savvy investors will ask founders about QSBS eligibility, often during due diligence. We won’t get into the fine details of QSBS since numerous financial advisors and tax attorneys such as Morgan Stanley and Lowenstein Sandler already provide great summaries.

Specialists Charge $2.5K to $25K for QSBS Attestation

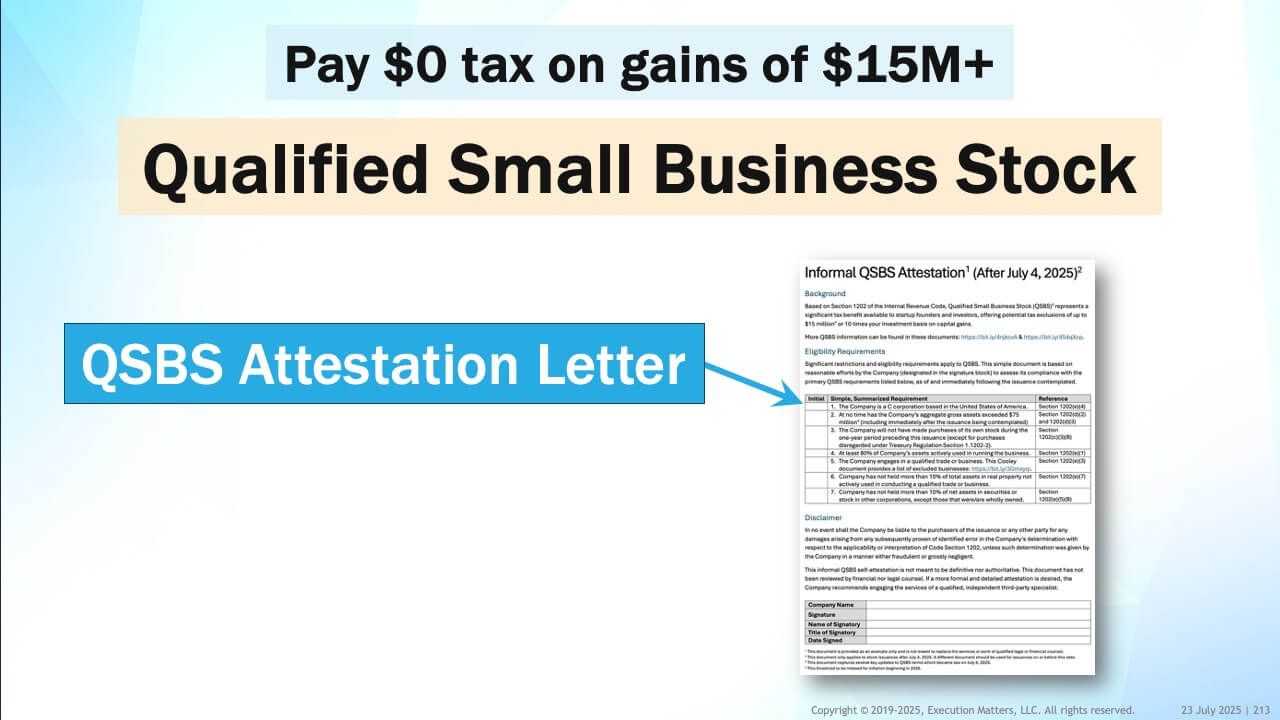

Instead, we focus on how founders can answer investor questions about QSBS eligibility with a QSBS attestation. QSBS eligibility is so important that multiple third parties now offer a review service with an attestation letter.

Although no attestation letter or statement is a guarantee that the Internal Revenue Service will accept the claims about QSBS eligibility, founders often pay $2,500 to $25,000 for a formal review to receive a third-party “seal of approval”.

Avoid or Defer Costs With an QSBS Self-Attestation

Founders can avoid or defer these costs by using the informal QSBS self-attestation form included in the toolkit from our Startup Due Diligence course. This informal attestation asserts that the startup satisfies seven key requirements for QSBS eligibility.

Be advised that QSBS eligibility includes significant and complex restrictions that go beyond the scope of the simple, one-page example included in the due diligence toolkit. As always, we advise founders to seek the guidance of qualified financial and legal counsel.

Important note: the toolkit includes separate QSBS informal self-attestation forms for stock issuances before and after July 4, 2025. Be sure to use the correct form for your situation.

Use Our Tools for Due Diligence (Including QSBS)

After going through multiple fundraises and funding due diligence dozens of times – from both the investor and the founder side – we built a library of tools to streamline and simplify the investor diligence process. By using the two dozen tools and templates – including our QSBS self-attestation – from our due diligence toolkit, founders can reduce costs, eliminate headaches, and accelerate the diligence process, increasing the chances of closing investor financing. Learn more about purchasing our Startup Due Diligence course here.